-

Why Is Mersin Becoming the New Antalya for Smart Investors?

Why Is Mersin Becoming the New Antalya for Smart Investors? Mersin is quickly rising as Turkey’s next real estate gem — offering Antalya-style living at much lower prices. With pristine beaches, a growing expat scene, and the new Çukurova International Airport, demand is booming. Property values are rising fast, especially in Tece (Mezitli). Now, thanks…

-

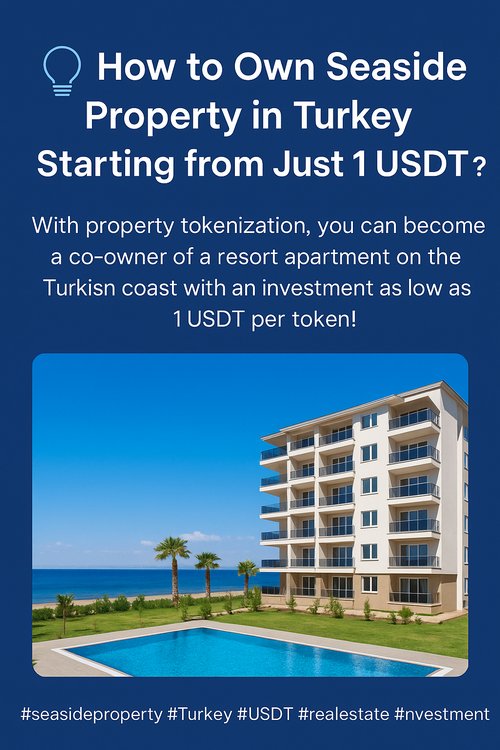

How to Own Seaside Property in Turkey Starting from Just 1 USDT?

How to Own Seaside Property in Turkey Starting from Just 1 USDT? Yes, you can co-own a beachfront apartment in Turkey — starting from just 1 USDT. Through real estate tokenization, platforms like MB Nature Resort let you invest in income-generating property on the Mediterranean without large capital. Each apartment is split into tokens. You…

-

Ethereum vs TON: The Battle for RWA Dominance

Ethereum vs TON: The Battle for RWA Dominance As RWAs go mainstream, Ethereum and TON lead the race — but in very different ways. Ethereum offers deep liquidity, DeFi dominance, and regulatory trust. Projects like Ondo thrive thanks to its mature infrastructure. TON is gaining fast. With low fees, Telegram-native UX, and global reach, it…

-

U.S. Regulatory Trends Around Tokenized Securities

U.S. Regulatory Trends Around Tokenized Securities In 2025, U.S. regulation of tokenized securities is accelerating. With rising institutional interest in RWAs, regulators are pushing for clarity. The SEC still treats most tokenized assets as securities, requiring registration and investor protections. This impacts platforms offering real estate, debt, or private equity tokens. The CFTC is stepping…

-

Why ONDO and TokenFi Remain Hot in May 2025

Why ONDO and TokenFi Remain Hot in May 2025 In a shaky altcoin market, ONDO and TokenFi are leading the RWA wave with real utility. ONDO is booming with demand for tokenized Treasuries, backed by BlackRock partnerships and institutional traction. It recently broke back above $1. TokenFi targets retail investors, offering easy tokenization tools and…

-

BlackRock and Fidelity Double Down on RWAs — What’s Next?

BlackRock and Fidelity Double Down on RWAs — What’s Next? In 2025, BlackRock and Fidelity expanded into RWAs, confirming that tokenized assets are now core strategy — not just an experiment. BlackRock launched its BUIDL fund on Ethereum and backed Securitize. Fidelity explored tokenized mutual funds and real estate via Fidelity Labs. Why it matters:✔…

-

Spotlight: AUT Token by Autentic Capital – Real Utility or Just Hype?

Spotlight: AUT Token by Autentic Capital – Real Utility or Just Hype? The AUT token isn’t hype — it’s built for real use within the Autentic Capital ecosystem. Unlike speculative coins, AUT powers a platform that tokenizes income-generating real estate with full legal compliance. What makes AUT stand out?✔ Staking & governance for protocol decisions✔…

-

The Mantra Collapse: What It Means for the RWA Industry

The Mantra Collapse: What It Means for the RWA Industry Mantra’s collapse was a major wake-up call for the RWA space. Once seen as a leader in decentralized asset tokenization, the project failed due to weak governance, poor transparency, and lack of investor protection. As a result, investors began exiting risky platforms, while capital shifted…

-

Most Popular Blockchains for RWA Tokenization in 2025

Most Popular Blockchains for RWA Tokenization in 2025 As RWAs go mainstream, blockchains that offer speed, compliance, and scalability lead adoption in 2025. Ethereum – The most trusted for institutional RWAs like Ondo, despite high fees.Polygon – Low-cost L2 ideal for real estate and asset tokenization.TON – Fast, scalable, and Telegram-native. Used by platforms like…

-

Legal Frameworks Behind RWA Projects

Legal Frameworks Behind RWA Projects For Real-World Asset (RWA) projects, legal clarity is key. Without it, tokenization lacks trust and can’t scale. Unlike DeFi, RWAs must follow real laws. Platforms like Autentic Capital use SPVs, KYC/AML, and proper licensing to ensure each token represents a legally protected asset — whether it’s real estate, loans, or…