-

⚖️ How Regulation Impacts the RWA Market

⚖️ How Regulation Impacts the RWA Market Regulation is a double-edged sword for Real-World Assets (RWA). On one hand, it can unlock massive adoption. On the other—it can slow everything down. Why regulation matters: ✅ It builds trust and attracts institutional investors. ✅ Ensures legal clarity for platforms and token issuers. ✅ Helps protect investors…

-

Why DeFi and RWA Need Each Other

Why DeFi and RWA Need Each Other At first glance, DeFi (Decentralized Finance) and Real-World Assets (RWA) seem like two separate worlds. But in reality, they complete each other. Here’s why this synergy matters: RWAs bring stability to the DeFi ecosystem. Real assets like property and bonds reduce reliance on volatile crypto assets. ⚡ DeFi…

-

Successful Cases of Business Tokenization

Successful Cases of Business Tokenization Tokenizing businesses isn’t a distant dream—it’s already a thriving reality. Companies worldwide successfully tokenize assets, creating new investment opportunities and reshaping the financial landscape. Notable examples include: Aspen Coin: Successfully tokenized the luxury St. Regis Aspen Resort, raising millions and offering investors fractional hotel ownership. Masterworks: Democratized fine art investment…

-

RWAs vs. Traditional Investments: Risks & Returns

RWAs vs. Traditional Investments: Risks & Returns Investors today face a choice: stick with traditional investment methods or explore Real-World Assets (RWAs) tokenized via blockchain. But how do RWAs measure up against traditional investing? ⚖️ Comparative Overview: RWAs: ✅ Greater liquidity and flexibility due to blockchain-enabled fractional trading. ✅ Enhanced transparency and trust thanks to…

-

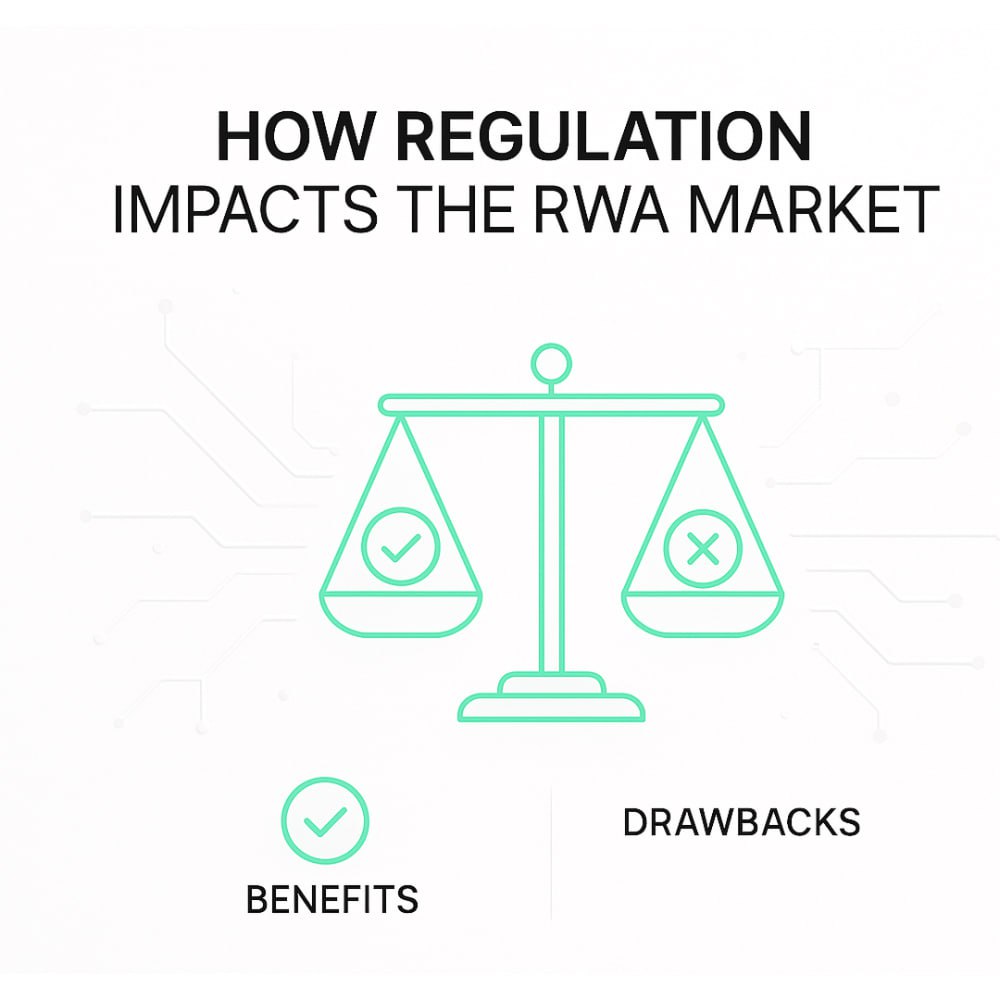

How Blockchain Solves Trust Issues in Real Estate

How Blockchain Solves Trust Issues in Real Estate Real estate markets have always struggled with trust—complex paperwork, fraud risks, and hidden costs make investors cautious. But blockchain technology is changing the game completely. Here’s how blockchain boosts trust: Transparency: Blockchain’s decentralized ledger records every transaction securely, making fraud practically impossible. Immutable Records: Once entered, transaction…

-

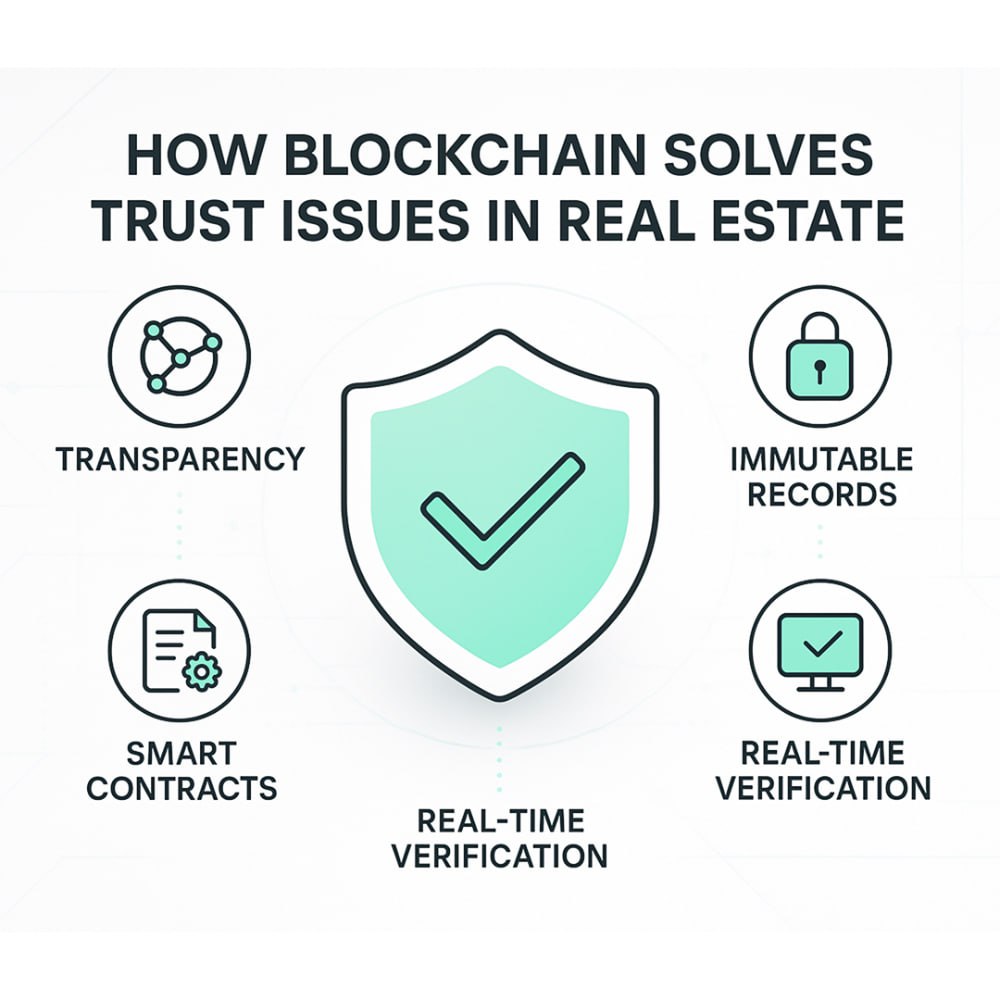

Top Platforms to Invest in RWAs in 2025

Top Platforms to Invest in RWAs in 2025 Looking to invest in Real-World Assets (RWAs) but not sure where to start? Here are the top platforms leading the way in asset tokenization: RealT: Specializes in tokenized U.S. real estate, offering fractional investments with regular rental income distributions. Polymath: Focused on securities tokenization, Polymath provides robust…

-

5 Reasons to Invest in RWAs through Crypto

5 Reasons to Invest in RWAs through Crypto Investing in Real-World Assets (RWAs) using crypto isn’t just innovative—it’s financially savvy. Here’s why: 1️⃣ Liquidity Boost: Convert illiquid assets into easily tradable tokens, drastically reducing your waiting time for deals to close. 2️⃣ Fractional Ownership: No more hefty capital requirements—own fractions of premium properties or valuable…

-

What Exactly Are Real-World Assets (RWA)?

What Exactly Are Real-World Assets (RWA)? Real-World Assets (RWAs)—a revolutionary investment class reshaping the way we view traditional finance. But what exactly are they? Imagine taking tangible assets like real estate, gold, or corporate bonds, and digitizing their ownership via blockchain technology. This innovative approach, known as tokenization, transforms illiquid, high-value assets into tradable tokens,…